dependent care fsa rules 2021

If you have a dependent care FSA pay special attention to the limit change. For 2021 only the DCFSA contribution limit for qualifying dependent care expenses is increased from 5000 to 10500 for individuals or married couples filing jointly and from 2500 to 5250 for married individuals filing separately.

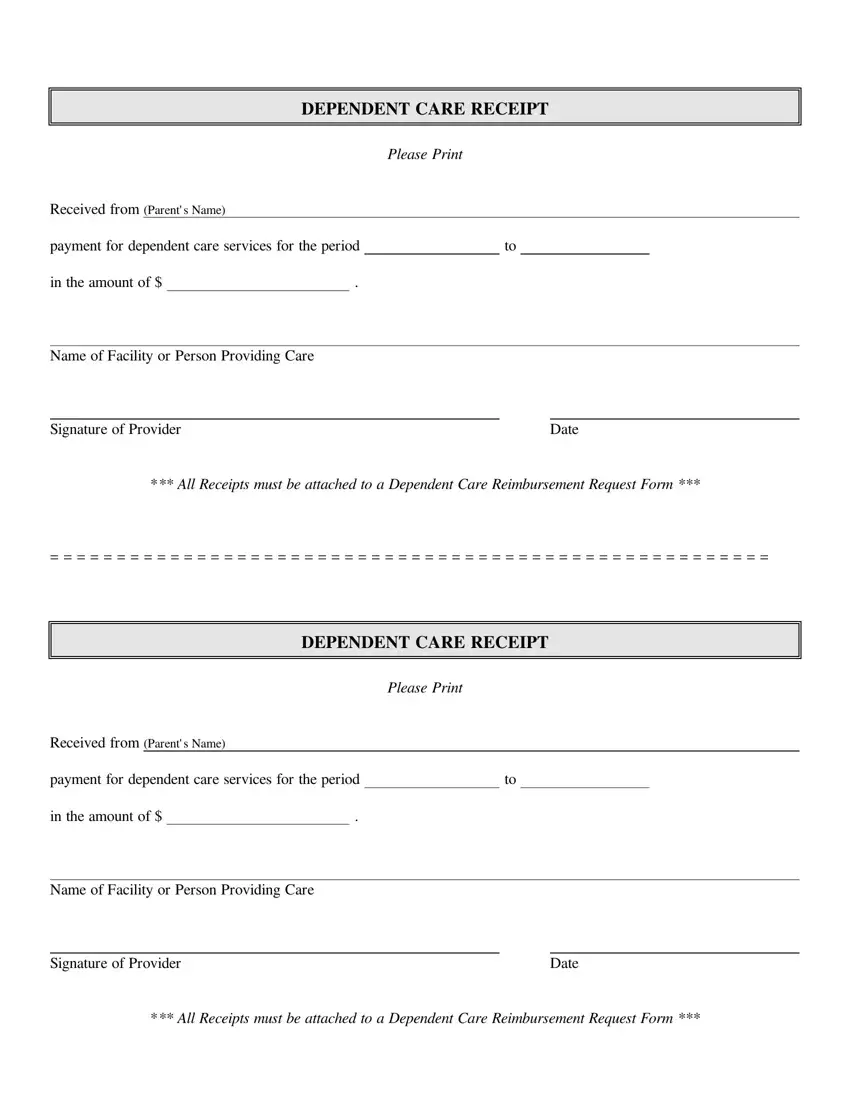

Explore Our Image Of Dependent Care Fsa Nanny Receipt Template Receipt Template Receipt Templates

Posted 2021-07-12 July 12 2021.

. With a Dependent Care FSA you use pre-tax dollars to pay qualified out-of-pocket dependent care expenses. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500. In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing separately.

Contributing to this benefit reduces taxable income and spreads the benefits of pre-tax dollars throughout the year helping you save 30 percent or more on your dependent care. Dependent Care Flexible Spending Account Basics. Dependent Care FSA Eligible Expenses Care for your child who is under age 13.

2021-R-0054 February 11 2021 Page 3 of 4 unused health and dependent care FSA funds are forfeited at the end of the plan year known as the use it or lose it rule IRS Notice 2005-42. The employee cannot use their plan year 2020 balance for expenses incurred for that dependent beginning September 2 2021 because that child did not turn age 13 during. On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden.

If you are divorced only the custodial parent may use a dependent-care FSA. The most money in 2021 you can stash inside of a dependent-care FSA is 10500. The new contribution limit is 10500 for 2021 for single taxpayers and married filing jointly a limit that was previously set at 5000 per year.

The Only One-Stop-Shop Stocked Exclusively With FSA-Eligible Products. But employers may offer either a grace period or a carryover but not both to health FSA participants under certain circumstances. May 11 2021 Brian Gilmore Compliance Share Share on linkedin Share on facebook Share on twitter Share on email Executive Summary The IRS has issued guidance clarifying certain aspects of the American Rescue Plan Act of 2021ARPA 2021 dependent care FSA limit increase and the annual HSA limit increases for 2022.

The money you contribute to a Dependent Care FSA is not subject to payroll taxes so you end up paying less in taxes and taking home more of your paycheck. Change contributions during the year. A dependent care flexible spending account lets participants set aside pre-tax dollars to help pay for dependent care.

Carryover and Other Temporary Rules for 2021 Health and Dependent Care FSA Carryover. Dependent care FSA increase to 10500 annual limit for 2021. WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts attributable to carryovers or an extended period for incurring claims generally are not taxable.

Ad Shop The Largest Selection Of FSA-Eligible Products Today And Get Free Shipping 50. Included in the changes was the one-time change to the contribution limit for dependent care FSAs thats to say the contribution limit is not permanently changed but changed for 2021 only. Dependent Care FSA FAQs Alicia Main 2021-08-23T130406-0400.

The CAA extends the maximum age limit for dependents to be eligible for dependent care FSA reimbursements from age 13 to age 14 for the 2020 and 2021 plan years. The law increased 2021. This was part of the American Rescue Plan.

Health and dependent care FSA plans can now carryover ALL remaining balances. Up to a 12-month grace period For FSAs with a plan year ending in 2021 or 2022 employees can receive up to a 12-month grace period to use contributed funds. Typically if you dont spend your Dependent Care FSA funds by the end of the year you lose that money.

The limit is expected to go back to 5000. Dependent Care FSAs which previously allowed no carryover also have an unlimited carryover provision in 2021-2022. For 2022 and beyond the limit will revert to 5000.

Plan year 2020 Dependent Care FSA enrollee who enrolled by January 31 2020 has a dependent who turned age 12 during plan year 2020 and will turn age 13 on September 2 2021. This limit also is available for unused amounts carried over from the. The guidance also illustrates the interaction of this standard with the one-year increase in the.

Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March. The American Rescue Plan President Joe Biden s 19 trillion stimulus package boosted child-care assistance through temporary changes to dependent-care FSAs. Employers can choose whether to adopt the increase or not.

Double check your employers policies. Health and Dependent Care FSAs. ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only.

Employers can now permit a 12-month grace period for unused balances or. The increase in the DCFSA contribution limit is optional. Dependent eligibility situations where a dependent satisfies or ceases to satisfy the rules for eligible dependents due to the attainment of age.

The limit will return to 5000 for 2022. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022. For married couples filing joint tax.

Why You Should Consider A Dependent Care Fsa

Why You Should Consider A Dependent Care Fsa

Dependent Care Assistance Program Optum Financial

2021 Changes To Dependent Care Fsas And What To Know

Dependent Care Fsa Dcfsa Optum Financial

What Options Are Available In A Dependent Care Flexible Spending Account Now Tri Ad

Is The Dependent Care Credit Supposed To Be Negating My Depcare Fsa Bogleheads Org

2021 Irs Rules Allow For One Time Changes To Child Care Dependent Care Fsas San Francisco Health Service System

Irs Releases Guidance On Taxation Of Dependent Care Fsa Funds Provided Pursuant The Special Covid Relief Sequoia

Dependent Care Assistance Program Optum Financial

Change Dependent Care Fsa Contributions Midyear Kiplinger

More Generous Dependent Care Flexible Spending Account Maximum Limit Birch

Covid Relief Fsa Rules Provide Longer Periods To Spend Unused Balances Montgomery County Public Schools

Use A Dependent Care Account To Help Pay Nanny Or Caregiver Expenses

Dependent Care Receipt Fill Out Printable Pdf Forms Online

Dependent Care Fsa And Carryover Is Relief Coming Datapath Inc